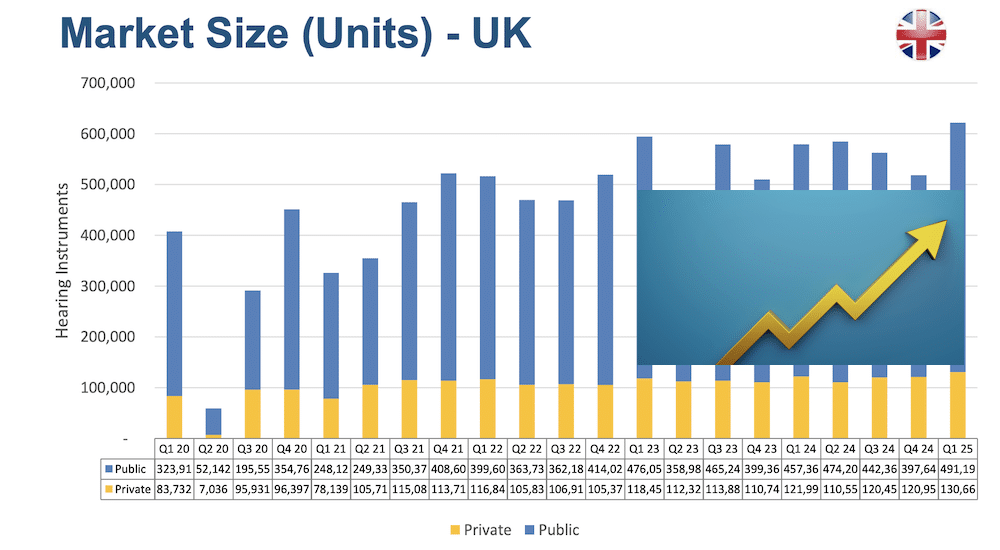

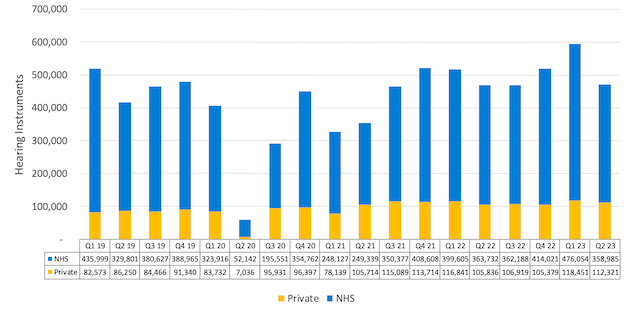

UK hearing instrument sales slip from Q1 high as NHS buy-in drops 25%

Q2 2023 figures from the British Irish Hearing Instrument Manufacturers Association (BIHIMA) underline the mercurial character of the UK hearing market, one dominated by orders from the NHS...and those orders fell dramatically in the second quarter of this year.

Audiology buy-in from the nation’s health service had soared during the first quarter of the year, but spring contract changeovers and supply chain challenges were factors being blamed for a huge 25% fall in Q2 NHS business, casting a shadow over the domestic panorama.

Private sales Q2 in the UK were only slightly down (0.5%) on Q1, and were encouragingly higher in Q2 2023 compared to 2022. But the 25% fall between Q1 2023 and Q2 2023 for NHS orders impacted on a 1.3% drop in NHS units from Q2 2022 to Q2 2023.

It should be noted that the first quarter of 2023 represented a record hike.

Nevertheless, the words of BIHIMA chairman Paul Surridge hint at an at-least pensive intake of breath across the industry. Data suggesting a fall in hearing instrument use are at variance with the hitherto steady signs of growth since recovery from the pandemic.

“We saw encouraging growth at the start of the year but the dip in sales data for Q2 shows how changeable the market can be.” says Surridge.

Rechargeables still rising

Rechargeable products, however, are continuing to rise outside of the NHS. UK units are creeping up quarter on quarter, with ROI units now over 50%, says BIHMA.

“It’s promising to see a steady growth of rechargeable hearing instruments. While the initial investment is higher, wearers save money in the longer term,” affirmed Surridge.

The full Q2 report, including similarly grey Republic of Ireland results, can be downloaded here.

Source: BIHIMA