Demant grows its shares of GN Store Nord, while latter gives its shareholders a gloomy audio division forecast

GN Store Nord has announced that it received a notification from William Demant Invest stating that William Demant Invest A/S increased its aggregate holding of shares to above 10% of the share capital and voting rights in GN Store Nord A/S.

The November 3 notification came just two days after GN’s Audio Division advised shareholders it was revising the GN Audio financial guidance on growth earnings per share (EPS) from between -10% to 0% to now “around -30%”.

GN also announced: “Although we are observing solid demand in the Enterprise market, we now expect lower than previously anticipated market growth in Q4.”

What are the three factors cited by GN for guidance revision?

GN is stressing that “the basic assumptions behind the guidance revision remain more uncertain than normal”, while putting the impact on business down to three factors. First on its list is the COVID-19 pandemic, but the global supply situation and a worsened macro-economic environment are also cited.

This November’s guidance revision, and the ensuing announcement of a share grab by Demant, might strike some as worthy of the word tremors, especially given the confident airs of GN’s recent 2021 Annual Report, in which the group was buoyant about its audio market, stating:”GN’s strategy for 2020 and beyond is to take individualized customer experience to a whole new level, and further broaden the reach and appeal of GN’s hearing, audio, video, and gaming product portfolios, where management sees ample opportunities for continued growth.”

“Despite the challenges, the market fundamentals for GN’s two central business pillars – the core hearing business and the audio business – are as strong as ever before,” the report maintained. There will be plenty of eyes now be on the release of GN’s interim Q3 2022 report on November 11.

Demant November 1 announcement also reveals growth resistance

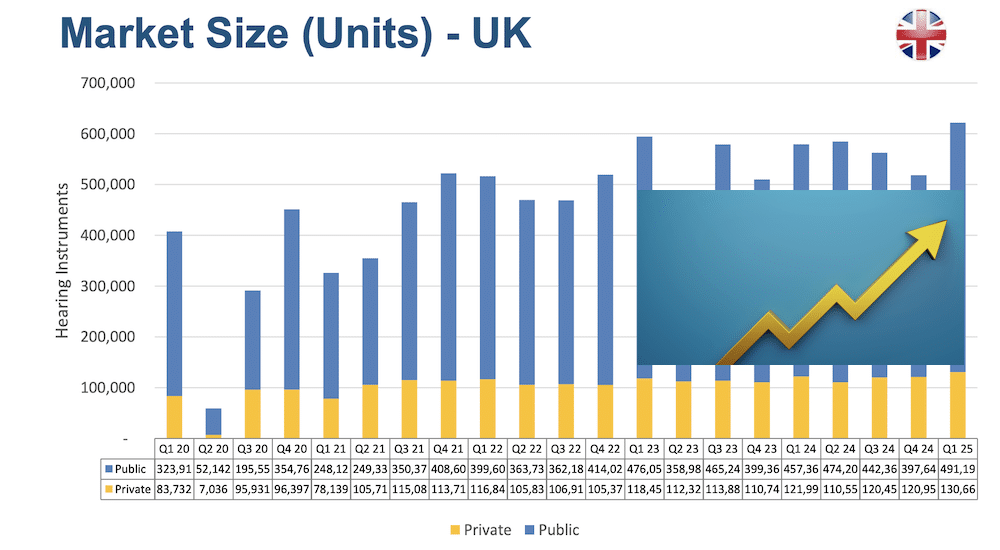

Demant has also revised its outlook, issuing on November 1 a pre-announcement of Interim Management Statement for Q3 2022. The Outlook for 2022 adjusted to reflect updated market views and lower-than-expected performance for the Group:Organic growth of 2-4% (prev. 4-6%) and EBIT of DKK 3,150-3,450 million (prev. DKK 3,500-3,800 million.

“In the third quarter of the year, our Diagnostics business has performed well and it continued to gain market share. Following recent negative development in our markets, we have seen lower-than-expected performance in our “Hearing Care, Hearing Aids and Communications businesses,” said Søren Nielsen, Demant President and CEO.

Source: GN/Demant