How major hearing aid manufacturer Demant is riding the COVID-19 roller coaster

financial

One of the world's leading hearing health instrument producers, the Danish giant Demant, has been revealing the shaking it has taken as a result of coronavirus lockdowns in its global marketplaces. However the wound is dressed, it's a scary gash, and Demant is understandably chary on a detailed prognosis for the market.

An early May interim management statement by Demant is as open a confession on the coronavirus damage as any outfit is likely to give at this point in the shock process, so investors and market analysts may be relieved to find some concrete calculations sustaining the group's description of its 2020 performance as "extraordinarily mixed".

If the coronavirus crisis were a roller-coaster ride, then the steady exhiliration of a healthy above-growth climb prior to mid-March, which Demant was happily recording, would find the subsequent gut-wrenching, almost-vertical fall just part of the adventure, and comfortingly predictable with regard to its future trajectory. But, as we now know, no one expected the earth to tumble off its axis just as the big dipper was on its way up.

And the plunge has been calibrated by Demant: across the group's hearing devices, wholesale, retail, hearing implants, diagnostics, and communications businesses, and including its online payments (EPOS), "revenue has been approximately 30% of our original expectations," reads the group's announcement.

To put that fall in context, keep imagining the Demant roller-coaster at the moment it approaches the first zenith (timeline mid-March and the announcement of first lockdowns and lockdown intent in Europe and the US). All good so far, with the group's star products, Oticon Opn S and Philips HearLink, leading "double-digit organic growth significantly above the estimated growth rate of the hearing healthcare market".

But here it comes! The business ride reaches Lockdown Peak 1, and falls plumb. Breakfast and lunch are withdrawn, along with any business analyst's capacity to calculate when this downward plummet will flatten out and avoid the hard ground somewhere, surely very close. Congratulations to Demant for immediately achieving a keep calm and grab a sickbag score of on the sanguinometer: "On 15 March, we withdrew our outlook for 2020 due to uncertainty of the impact of the current outbreak of coronavirus and the resulting changed outlook for the hearing healthcare market." Demant pleads lack of visibility; plea accepted. When in free fall from the 60th floor you can only be expected to have a very blurred view of whether that might be a safety net below or a Pomeranian fresh from the groomer.

Forecast for the market as a whole

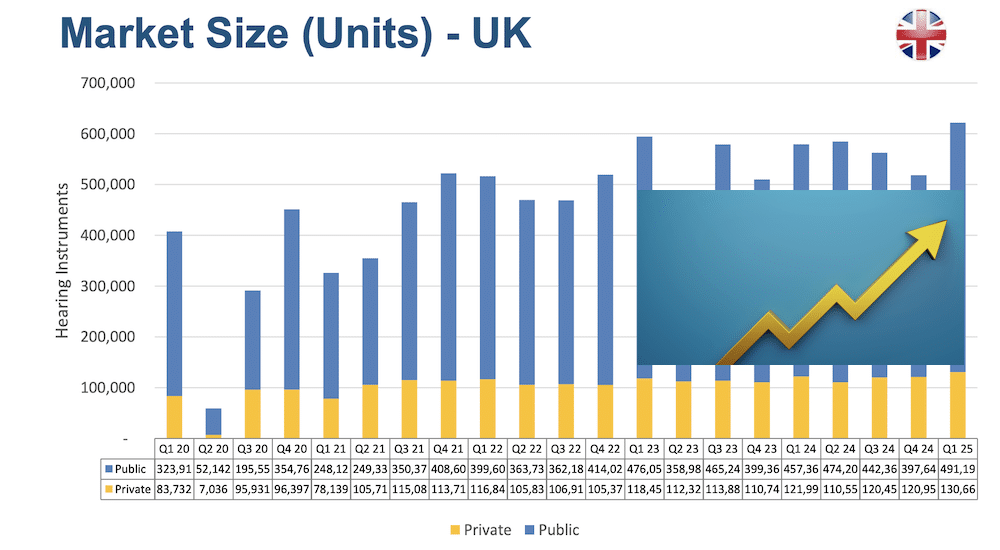

Since this axis shift affects the world's hearing health businesses fairly equally overall, and not just selected fairground rides, it's a given that other major players in the hearing market will be experiencing similar sensations to those shaking Demant, for which the lockdowns implemented as a result of COVID-19 concerns "have almost completely eliminated the ability to service patients and have had an unprecedented negative impact". The Danish multinational estimates that "the global hearing aid market is currently seeing a sales run rate of around 20% of what we would normally expect".

In free fall, it is a logical step to make yourself lighter. The availability of publicly-funded salary compensation schemes (such as furloughs) has allowed Demant to make staff cuts as part of reducing operating expenses to a run rate of "around 60%" of its original plans, plus lower distribution costs and administrative expenses, and R&D costs "kept deliberately more in line with our original plans".

Glimmers of hope and foreboding

Audiology services are still required, both from hearing care professionals and for patients in lockdowns. The move to telehealth options means products enabling remote treatment are proving an effective anti-gravity device for manufacturers hurtling downwards, and Demant's announcement shows the group is no exception as a beneficiary of this remote trend.

"Communications (EPOS) faced supply chain headwinds in the first months of the year, which hampered sales. However, sales have since then accelerated significantly driven by Enterprise Solutions, which has benefitted from the working-from-home trend that has followed in the wake of coronavirus. The current revenue run rate for EPOS is approximately 120% of our initial expectations of strong double-digit growth," affirmed Demant.

Some key financial aspects, however, offer less hope but could be far worse. Demant is "expecting negative cash-flow impacts". "As a result of our strong start to the year, the free cash flow has year-to-date been positive, but after acquisitions and share buy-backs, the net cash flow has been negative," the group announced days ago at the beginning of May.

Passing storm?

There is something admirable about trying to keep blue skies in view when the ground is approaching at the speed of light. Again, hats off to Demant for its ability to muster a forecast: "We believe that the negative impact of coronavirus will be temporary, and we see no changes to the fundamental drivers of demand for hearing healthcare products and services. However, we believe that the hearing healthcare market will only see a gradual recovery, which will likely carry over into 2021.

Søren Nielsen, Demant CEO, announcing positive news in pre-coronavirus times. © PW

President and CEO of Demant, Søren Nielsen is the man in charge of keeping vertigo under control. His physics is surprising but it fulfils the aim in sight. While he recalls the "very positive" start to 2020 for the group, he sees the ensuing nosedive as a question of "good momentum coming to a sudden halt" and "stalling", rather than a prime example of Newtonian universal gravity. Underlining the group's efforts "to serve customers and users in the best possible way with remote services, and in countries that are open," he continued. "But the situation for the Group is very challenging as we are facing a long road towards normalisation. It is difficult to estimate the time horizon, but it could carry over into 2021, and we are dedicated to doing what we can to get through this as fast as possible – with very high concern for people’s well-being."

Demant is waiting for improved visibility in order to make something of the current market blur and its own prospects as the situation evolves: "As soon as we are able to properly assess the impact of coronavirus on the hearing healthcare market and the derived impact on our own business, we will release an updated outlook for 2020."

And, of course, no money back for anyone who doesn't enjoy the ride.

Source: Demant